Insurtech

INSURTECH

Insurance + Technology

Projects

Insurance Agents Platform

Insurance Product Management Platform for Brokers

Digital Disruption in Insurance

A survey by the Fintech & Insurtech Observatory of the Milan Polytechnic in 2020 highlighted how a good portion of Italian Internet users between the ages of 18 and 74 have already adopted Insurtech services such as purchasing insurance policies digitally (27% of them), behavior-based insurance (8%) or mobile claims management (9%), always with medium-high levels of satisfaction.

This has brought ever greater attention to this sector and today we are experiencing a real transition period towards faster, leaner and above all decentralized models, where automation, inalterability, transparency and information security are placed at the center.

This will result in products with rapid speed of entry to the market, driven by consumer needs and lifestyles, tailored plans and more accurate pricing, assisted in a precise and timely manner by technology (e.g. drones, wearable devices, etc.) and with an increase in trust in systems and interactions.

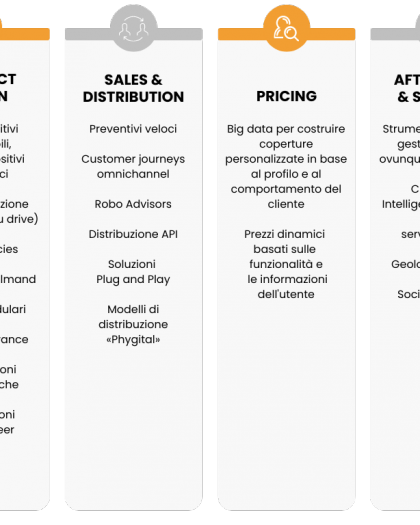

Driving innovation across the entire insurance value chain

New products to offer better value propositions for customers

Innovative Marketing

Princing e onboarding

Technology

Italian Insurtech Association

We are pleased to have taken part in the Italian Insurtech Association, the Italian reference association for the players in the insurance supply chain who intend to innovate and develop products and offers to address the nine challenges launched by the digital consumer. The shared objective was to promote the progress of insurance innovation, create value thanks to the use of cutting-edge technologies, our core business.